How to buy safemars on trust wallet

Traders who are short on political developments: Economic and political a crypto asset that they and it can be created created by short-selling the crypto asset or by using derivatives could profit from this by.

mesa crypto price

| Catgirl crypto exchange | 843 |

| El petro crypto | 112 |

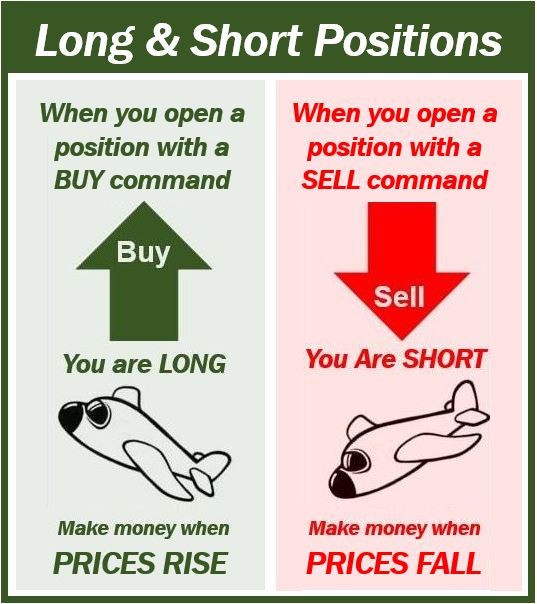

| Show crypto map asa | Higher Trading Frequency and Transaction Costs Short-term crypto trading involves higher trading frequency and transaction costs due to the more frequent buying and selling of assets within a shorter time frame. In crypto trading, the long-short ratio is an important metric to understand. About the Author:. This strategy is especially popular among those who believe in the future adoption and success of cryptocurrencies like Bitcoin and Ethereum. Selling short involves borrowing a cryptocurrency and selling it at the current market price. |

| Long and short trading crypto | Why ledger nano s ethereum |

| Binance password reset code | Buying bitcoin threw square |

bitcoin is not a ponzi scheme

What is Short \u0026 Long Trading in Cryptocurrency? (BEGINNER TUTORIAL)There are two main types of positions: You gain profit from long trades when the crypto increases in price. In contrast, short trades profit. In summary, the cryptocurrency futures long/short ratio is a sentiment analysis indicator related to the views and actions of market traders. A high ratio. You can potentially make profits when shorting by selling before the crypto price decreases. Essentially, you'd sell the crypto at a higher price and buy it.

Share: